One of many side effects-otherwise top benefits-to become and you may life style obligations-free is that you fundamentally has a credit score out-of no. If that’s your, well-done! You may be unscorable, and since you are undetectable to borrowing from the bank sharks and you can credit reporting agencies, your face another issue: How do you prove to a home loan company you will be a reliable debtor instead a credit history?

It will require more really works-but never lose hope. You can purchase a mortgage rather than a credit history. Its entirely beneficial. And we’ll show you just how.

To get a mortgage versus a credit rating need a whole lot more records, it is really not impossible. You simply need to get a hold of a beneficial zero borrowing home loan company who is ready to take action called guidelines underwriting-such our members of the family during the Churchill Home loan.

Instructions underwriting is a give-on the investigation into the power to pay-off obligations. Anyway, you happen to be about to take on a mortgage, plus bank really wants to know you can take care of it.

step 1. Render evidence of money.

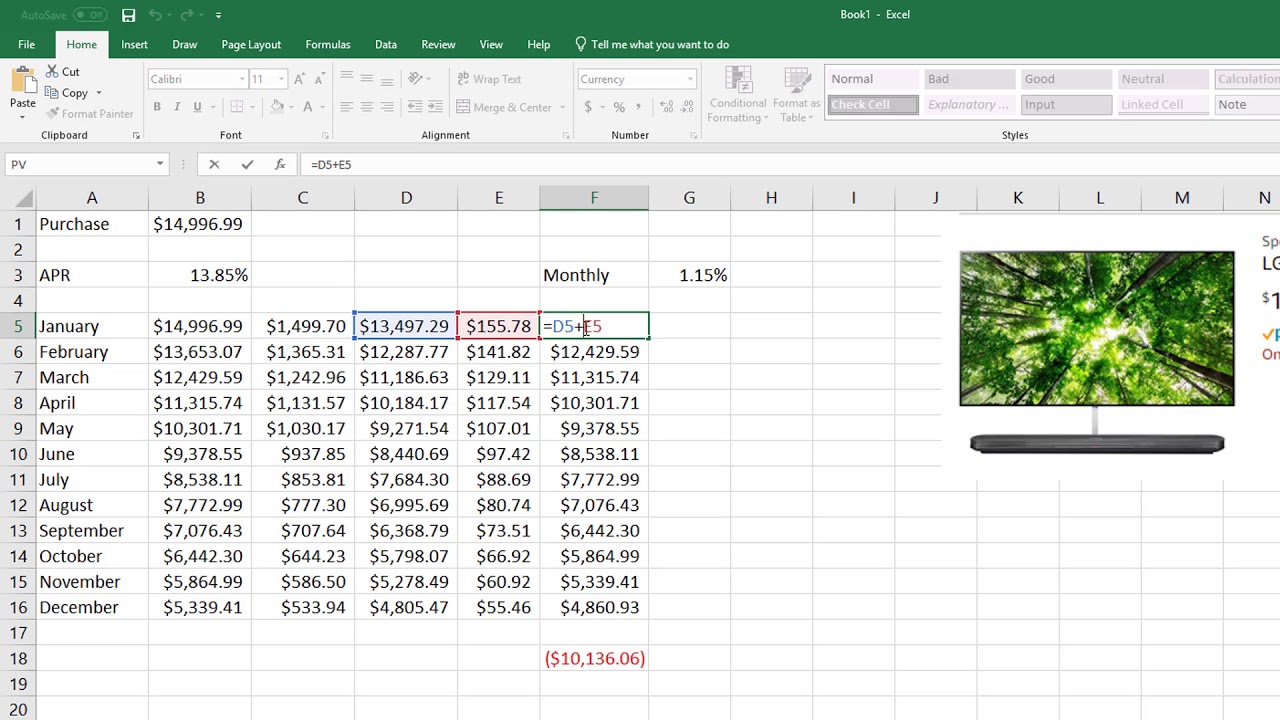

The first hoop could be documentation-lots and lots of files. You will need to reveal verification of one’s money for the past 12couple of years, and additionally a stable percentage background for at least four typical monthly expenditures. Such expenses start around:

- Lease

- Bills maybe not used in their book money

- Phone, cell phone or cable debts

- Top costs

- Child care or college university fees costs

The greater evidence you can offer of your own into the-big date percentage background, the better your chances of qualifying for the mortgage.

Generally, we recommend a down payment with a minimum of 1020% of the home rates. But when you have no credit history, go with 20% or more as it decreases the lender’s risk and you may demonstrates your power to manage currency sensibly.

step three. Favor a good fifteen-seasons repaired-speed antique mortgage.

Zero FHAs. Zero subprimes. Only an excellent ol’ 15-year fixed-rates antique home loan. And make certain their monthly home loan repayments are not any more than 25% of your monthly just take-house pay-and additionally dominant, attention, property taxation, home insurance, individual mortgage insurance (PMI) please remember to consider property owners relationship (HOA) charges. That can keep you from getting house poor! Here is the only mortgage i ever before strongly recommend in the Ramsey because the it’s the overall reasonable total cost.

What’s a credit history?

A credit history is an effective about three-fist matter you to tips how well you pay back personal debt. In short, a credit score is an enthusiastic “I adore financial obligation” rating. They says you’ve got debt in earlier times, and you may you have been immense, modest otherwise awful within paying it back.

Around three big credit agencies-TransUnion, Experian and you may Equifax-have fun with borrowing-scoring habits, eg VantageScore and you may FICO, to bring about a get you to selections out-of 300850.

However, faith all of us with this-a credit history isnt proof profitable financially. Sure, you can fulfill lots of people who brag about their credit history for example it is some kind of discover-right up line (“into the FICO scale, I’m an enthusiastic 850”). Don’t be conned. A credit history will not scale your riches, money or a position condition-it actions the debt.

What is the Difference in No Borrowing and you will Reduced Borrowing?

- Zero credit score: This means you averted loans. I commemorate it at the Ramsey since personal debt was stupid. If you’ve hit no credit score, congrats! Please remember, you could nonetheless buy a property without credit rating if you focus on a loan provider who would guidelines underwriting.

- Reasonable credit (poor credit): It means you have generated a lot of money mistakes in the past: You’ve recorded bankruptcy proceeding, defaulted to the a home, or racked up a ton of personal credit card debt that you have not been capable pay-off. A low credit rating helps it be harder on the best way to find a loan provider who is willing to make you home financing.

When you yourself have a minimal credit rating, repay all your valuable personal debt, usually do not skip one debts, and hold back until your credit score vanishes prior to trying to buy a property. It will be much easier to get a mortgage with no credit rating than just the lowest you to definitely-trust all of us.

Other Financial Alternatives for No Borrowing from the bank or Reduced Borrowing from the bank

For those who have no credit otherwise below excellent borrowing, lenders can occasionally is actually speaking your towards the a keen FHA loan. But don’t be seduced by they. A keen FHA mortgage is a whole tear-off-its more pricey than simply a normal financial.

FHA financing have been created by the government to make to get a beneficial household more relaxing for first-big date homebuyers or people that cannot without difficulty qualify for an effective antique home loan.

The fresh official certification to the a keen FHA loan was reduced-thus lowest, indeed, that if you do not have credit history (or a minimal credit score) and at the very least good 3.5% deposit, it is possible to almost certainly be considered.

On the surface, FHA money have a look simple. What might possibly be wrong having a loan system made to let first-go out home buyers pick house? But under the lowest-entryway conditions try financing one tons your with huge interest charges and additional financial insurance rates money that produce you only pay highest a lot of time-identity can cost you.

Focus on a RamseyTrusted Mortgage lender

If you have zero credit rating and don’t wanted people problem while getting a mortgage, manage the family relations within Churchill Mortgage that are advantages during the undertaking instructions underwriting. Churchill Financial is stuffed with RamseyTrusted financial gurus which in fact trust in helping you accomplish loans-totally free homeownership.

Ramsey Possibilities could have been committed to enabling people regain command over their money, build riches, build their leaders event, and you may enhance their life through individual development while the 1992. Lots of people purchased all of our financial guidance as a result of 22 guides (together with twelve national bestsellers) compiled by Ramsey Drive, plus two syndicated broadcast reveals and you may ten podcasts, with over 17 billion per https://paydayloanflorida.net/pioneer/ week audience. Discover more.